Cheyenne Federal Credit Union: Exceptional Financial Providers for You

Cheyenne Federal Credit Union: Exceptional Financial Providers for You

Blog Article

Federal Cooperative Credit Union: Your Gateway to Financial Success

By providing tailored instructional sources and financial options, Federal Credit rating Unions lead the means for their members to reach their economic goals. Sign up with the discussion to reveal the crucial benefits that make Federal Credit Unions the portal to economic success.

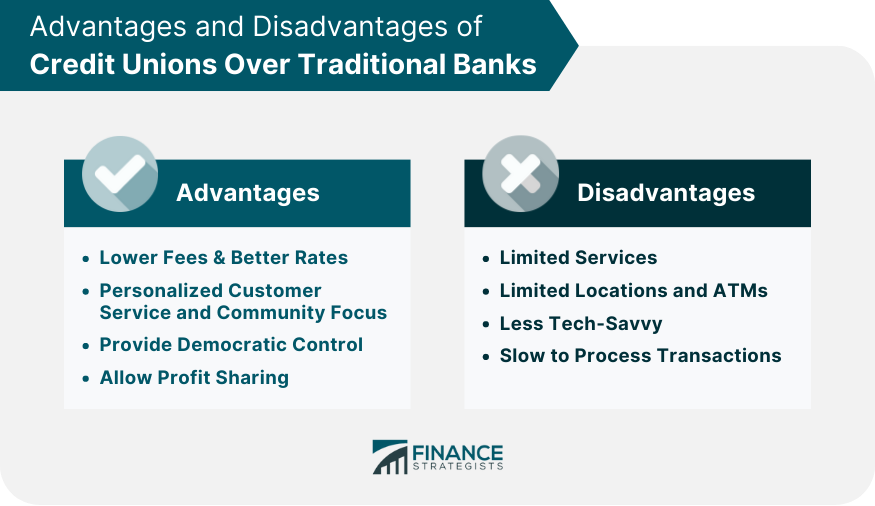

Advantages of Signing Up With a Federal Lending Institution

Joining a Federal Credit report Union offers numerous advantages that can substantially boost your financial well-being. One of the vital benefits is commonly lower fees contrasted to traditional banks. Federal Cooperative credit union are not-for-profit companies, so they frequently have lower overhead costs, enabling them to pass on these savings to their participants in the kind of lowered costs for services such as examining accounts, lendings, and credit report cards. Additionally, Federal Cooperative credit union generally provide higher rates of interest on savings accounts and certificates of down payment (CDs) than traditional financial institutions, supplying participants with the possibility to expand their financial savings faster.

One more advantage of signing up with a Federal Credit rating Union is the customized service that members obtain - Cheyenne Federal Credit Union. Unlike large financial institutions, Federal Cooperative credit union are understood for their community-oriented method, where members are dealt with as valued people instead of just an account number. This individualized solution frequently converts into even more tailored financial solutions and a much better overall banking experience for members

Series Of Financial Solutions Used

Federal Credit score Unions provide a detailed array of financial services created to provide to the varied demands of their members. These institutions focus on economic education by providing workshops, workshops, and on the internet sources to encourage participants with the expertise needed to make informed monetary choices. By using this wide array of services, Federal Credit score Unions play a crucial function in supporting their members' financial health.

Competitive Rates and Personalized Service

In the world of economic solutions offered by Federal Credit scores Unions, one standout element is their dedication to providing competitive prices and individualized service to make certain members' contentment. These competitive prices prolong to different economic products, consisting of cost savings accounts, lendings, and credit rating cards.

Exclusive Conveniences for Members

Members of Federal Debt Unions obtain access to an array of unique advantages designed to improve their monetary health and total financial experience. Federal Credit rating Union participants likewise have access to customized economic suggestions and aid in developing spending plans or managing financial obligation.

On top of that, Federal Lending institution often use benefits such as affordable rates on insurance coverage products, debt surveillance services, and identity burglary security. Some lending institution even provide unique participant discounts on regional occasions, destinations, or services. By coming to be a participant of a Federal Cooperative credit union, individuals can take pleasure in these exclusive advantages that are customized to help them save cash, develop wide range, and achieve their monetary objectives.

Achieving Financial Goals With Federal Debt Unions

Credit unions serve as important partners in aiding people achieve their monetary goals through tailored economic options and tailored support. One crucial element of attaining economic objectives with federal credit unions is the focus on member education.

Additionally, federal credit score unions supply a variety of services and products designed to sustain members within their monetary landmarks. click to read more From affordable interest-bearing accounts and low-interest loans to retired life planning and financial investment chances, credit score unions offer comprehensive services to deal with varied financial demands. By leveraging these offerings, participants can construct a strong monetary structure and work towards their long-term goals.

Furthermore, government credit history unions often have a community-oriented approach, promoting a feeling of belonging and support amongst members. This communal aspect can further encourage individuals to remain devoted to their financial goals and celebrate their accomplishments with similar peers. Ultimately, partnering with a federal cooperative credit union can dramatically enhance an individual's journey in the direction of economic success.

Conclusion

Finally, federal cooperative credit union offer a series of monetary solutions and benefits that can assist people accomplish their economic objectives. With competitive rates, customized solution, and special member advantages, these not-for-profit organizations work as a portal to financial success. By prioritizing member education and check here learning and neighborhood involvement, government cooperative credit union equip individuals on their journey in the direction of monetary stability and success.

By supplying tailored financial remedies and instructional resources, Federal Debt Unions lead the method for their members to reach their financial objectives. These establishments focus on monetary education by offering workshops, workshops, and on the internet resources to equip members with the expertise needed to make enlightened economic choices. Whether it's applying for a finance, setting up a savings strategy, or looking for monetary guidance, Find Out More members can anticipate tailored solution that prioritizes their economic health.

:max_bytes(150000):strip_icc()/dotdash-credit-unions-vs-banks-4590218-v2-70e5fa7049df4b8992ea4e0513e671ff.jpg)

Report this page